Mastering Scalp Trading in Forex: Strategies and Insights

Scalp trading is a popular form of trading in the Forex market, primarily due to its potential for quick profits. Traders who engage in scalp trading, often referred to as scalpers, aim to exploit small price movements within short time frames. For those interested in leveraging this strategy effectively, understanding its mechanics, risks, and techniques is essential. In this article, we will delve into the nuances of scalp trading, provide practical tips, and highlight resources such as scalp trading forex Philippine Trading Platforms for traders looking to enhance their skills.

What Is Scalp Trading?

Scalp trading is defined as a trading strategy that involves making numerous trades daily, holding positions for a very short duration—often just a few seconds or minutes. The primary goal is to capture small price movements in the market, accumulating profits through these incremental gains. This approach requires focus, speed, and a well-defined trading plan. Unlike traditional trading, which may involve holding positions for hours, days, or even weeks, scalp trading demands a different mindset and skill set.

Understanding the Basics of Forex Scalp Trading

To successfully engage in Forex scalp trading, traders must understand several key components:

- Market Liquidity: Scalpers thrive in highly liquid markets where price movements are quick and efficient. Major Forex pairs like EUR/USD or USD/JPY are often preferred due to their liquidity.

- Technical Analysis: Scalpers rely heavily on technical analysis, using charts and indicators to identify potential entry and exit points. Familiarity with various technical indicators is crucial.

- Risk Management: Given the fast-paced nature of scalp trading, robust risk management strategies are essential to protect capital and minimize losses.

- Broker Choice: Selecting the right broker can significantly impact a scalper’s performance. Look for brokers with low spreads and high execution speed.

Essential Tools for Scalpers

Effective scalp trading depends on having the right tools at your disposal. Here are some essential tools that every scalper should consider:

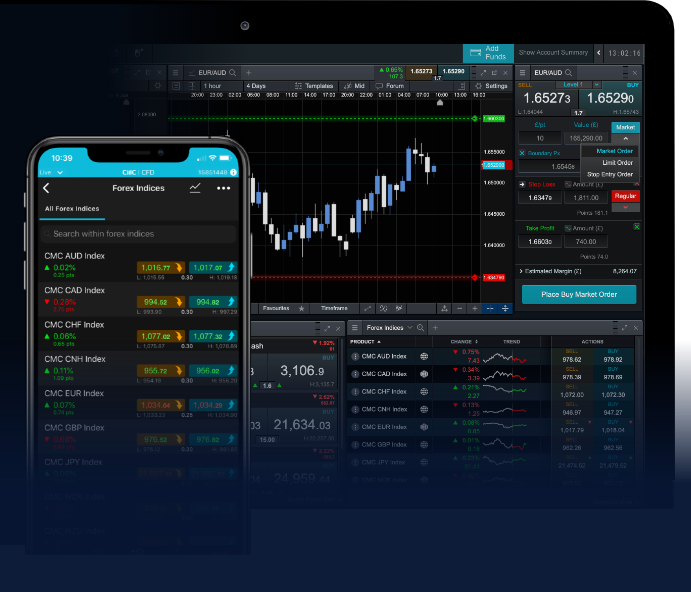

- Trading Platform: A robust trading platform with real-time data and quick execution capabilities is critical. Ensure that the platform supports scalping strategies.

- Technical Indicators: Indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands can aid in identifying entry and exit signals.

- News Feed: Staying updated on market news and economic data releases can help traders anticipate price movements and adjust strategies accordingly.

Scalp Trading Strategies

Scalpers employ various strategies tailored to their specific trading style and market conditions. Here are some popular approaches:

1. Range Trading

Range trading involves identifying key support and resistance levels. Traders aim to buy at support and sell at resistance, capitalizing on price oscillations within a defined range. This strategy is effective in sideways markets where strong trends are absent.

2. Momentum Trading

Momentum trading focuses on identifying strong price movements and entering positions in the direction of the trend. Scalpers look for rapid price changes, often bolstered by high trading volume, to catch quick profits.

3. Breakout Trading

Breakout trading involves entering trades following a price breakout from a defined range or chart pattern. Scalpers who employ this strategy aim to capitalize on the volatility that often accompanies breakouts, capturing swift movements.

4. News Trading

News trading capitalizes on the volatility that results from economic news releases and geopolitical events. Scalpers may enter trades just before significant announcements, aiming to profit from rapid price fluctuations.

Risk Management in Scalp Trading

As with any trading strategy, managing risk is of utmost importance in scalp trading. Here are some crucial risk management techniques:

- Set a Stop-Loss: Always place a stop-loss order to limit potential losses. This step is critical because the fast-paced nature of scalp trading can lead to significant drawdowns if not managed properly.

- Define a Profit Target: Establish clear profit targets for each trade to ensure you capitalize on small gains before they dissipate.

- Keep Position Size Small: Limit the size of your trades to reduce the impact of losses on your overall capital.

- Evaluate and Adjust: Regularly review your trades to identify successful strategies and areas for improvement. Adjust your approach based on past performance.

Psychological Aspects of Scalping

Scalping can be mentally taxing due to the rapid-fire nature of trades and the high stakes involved. Cultivating the right mental attitude is paramount:

- Stay Disciplined: Fallen prey to emotions like fear and greed can undermine your trading performance. Stick to your strategy and maintain discipline.

- Keep a Clear Mind: Avoid trading when feeling stressed or distracted. A clear mind is essential for making quick decisions.

- Practice Patience: While scalp traders aim for quick results, patience is necessary to wait for the right trading setups to materialize.

Conclusion

Scalp trading in the Forex market offers exciting opportunities for traders willing to dive into the fast-paced world of short-term trading. By understanding the mechanics of scalp trading, employing effective strategies, and managing risk diligently, traders can elevate their performance and achieve consistent profits. Whether you are a novice or an experienced trader, leveraging the right tools and platforms, like those available at Philippine Trading Platforms, can significantly enhance your trading experience. Continuous learning and adaptation will be key as you navigate the dynamic landscape of scalp trading.

Добавить комментарий